r&d tax credit calculation uk

Our RD Tax Credit Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC. Step 1 the credit discharges any corporation tax liability for the claimant in the accounting period.

Registered in England Wales Company Number 11437826.

. Ad Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. Data Protection Number ZA453238. ForrestBrown is the UKs leading specialist RD tax credit consultancy.

12 from 1 January 2018 to 31 March 2020. Get an estimate on how much your RD claim could. CT due of 615600 prior to use of RDEC.

Average calculated RD claim is 56000. The qualifying expenditure is 100000 thats already in accounts as expenditure. On this page you can calculate the value of your Research Development tax credits claim.

As a tax benefit. Comprehensive Hasty Service. Research and Development Tax Credits are a UK tax incentive that encourage companies to invest in RD.

Contact us to find out how much RD tax benefits could be worth to your business. Assuming your business fits these criteria you can check below for example calculations for RD tax credits. The average value of a claim in the SME and RDEC schemes is 53876 and 272881 respectively.

Enhanced RD qualifying spent would be now 325000 x 130 which makes the revised loss of 275000. Find Out If Your Company Is Eligible To Claim RD Tax Credit Before The 2020 Deadline. Calculate how much RD tax relief your business could claim back.

Ad Submit HMRC RD Tax Credit Claims via Direct RD. In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on RD projects and make an RD tax credit claim they. Enter your sub-contracted costs that are directly related to RD projects.

Ad Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. How to calculate the RD tax credit using the traditional method. The rate of relief is 25.

2004 How will the reduced ODA budget affect RD funding. Ad Advise Your Clients With An RD Tax Credit Partner You Trust. Please provide a valid how much have you invested in rd over the last year.

This can include freelance sub-contractors that are actively involved in development activities as well as agency. Get the cash injection you deserve with Direct RD and submit your claim today. RDvault charges a fixed price for your RD claim from 249 up to a maximum of 1995 for any size claim.

Ad Reinvest Grow Your Startup. It was increased to. Show how this example is calculated.

Ad Reinvest Grow Your Startup. Direct RDs Claim Process Saves You 4000 - 8000 Based on the Avg. A Profitable SME RD Tax Credit Calculation Lets assume the following.

We estimate you could receive up to. Copious Limited Floor 2 9 Portland Street Manchester M1 3BE. The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable.

Ad Submit HMRC RD Tax Credit Claims via Direct RD. Comprehensive Hasty Service. ForrestBrown is the UKs leading specialist RD tax credit consultancy.

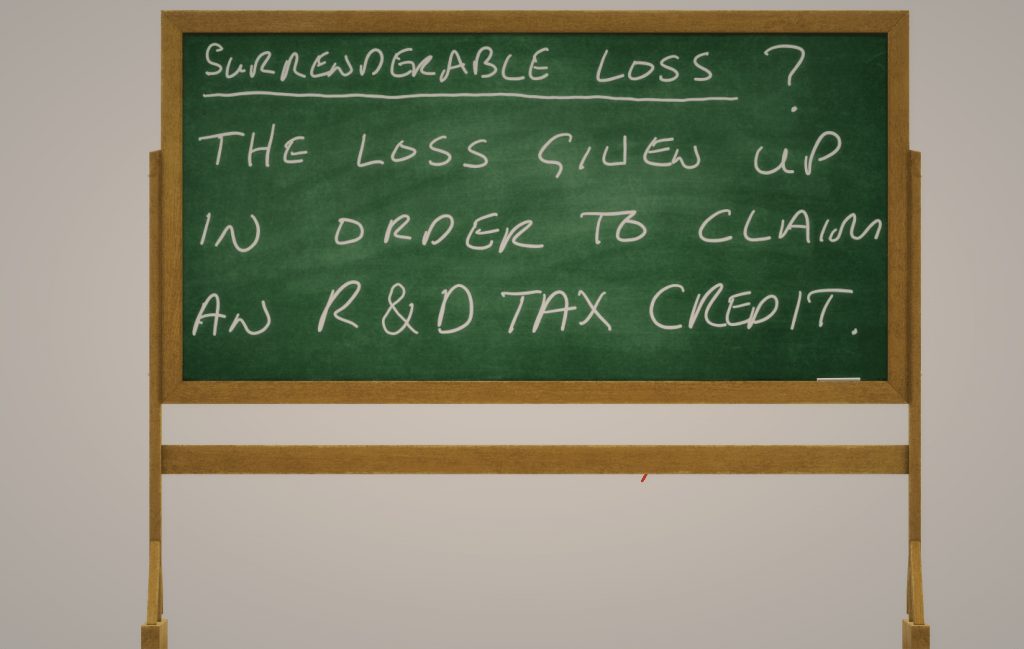

Tax Credit Studies May Not Be Something You Do Everyday Luckily For You Tri-Merit Does. RD Tax Credits Calculator. Surrender of losses in return for payable tax credit up to 33 of qualifying expenditure For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss.

1805 Why you need an RD tax specialist on your side 1105 FI International RD Tax Incentives Guide 2022. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend. RD Tax Credit Calculator.

Find Out If Your Company Is Eligible To Claim RD Tax Credit Before The 2020 Deadline. Our award-winning team includes chartered tax advisers tech experts ex-HMRC inspectors. Direct RDs Claim Process Saves You 4000 - 8000 Based on the Avg.

So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill. The rate of relief is 25. You could receive up to 000 in.

Find Out In Under 20 Minutes If You Can Claim A Tax Credit. 2403 UK 2022-2025 RD Budget. How much have you invested in RD over the last year.

If youre a loss-making business youll receive your RD tax credit in. Free RD Tax Calculator. This calculation example shows how RD tax credits can benefit a.

Company X made profits of 400000 for the year calculate the RD tax credit saving. If you add back the qualifying costs of 125000 the company would have a profit of 75000. The business must claim the payroll tax credit election on an originally filed federal income tax return.

Companies can reduce their tax bill and recover up to 13 of their. RDvault charges a fixed price from 749 capped at 1995 for. To put it another way 75000 of the expenditure has already attracted relief and.

This can be done for the current financial year and the 2 previous. According to the latest available figures UK companies claimed a total of 74. The RDEC is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017.

If the company spent 100000 on RD projects in a year. SME Claim of 41k. SME Claim of 41k.

Find Out In Under 20 Minutes If You Can Claim A Tax Credit. RD Tax Credit Calculator. If you spend money creating or improving products or services.

Sme Scheme Explained How To Claim How Much You Are Owed

Sme Scheme Explained How To Claim How Much You Are Owed

Hmrc S Rules Explained Which Costs Qualify For R D Claims

How To Enter Research And Development Claims

Rdec Scheme R D Expenditure Credit Explained

How To Claim Hmrc Research Development R D Tax Credits Easily

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Rates For Rdec Scheme Forrestbrown

Work Out Your Salary After Taxes At Maltasalary Com Salary Workout Tax

How Is R D Tax Relief Calculated Guides Gateley

R D Advance Funding Early Access To Your R D Tax Credit Mpa

Calculating The R D Tax Credit Randd Tax

R D Tax Credit Calculation Examples Mpa

Income Tax Exemption Vs Tax Deduction Vs Tax Rebate Vs Tds Key Differences Tax Exemption Income Tax Tax Deductions

R D Tax Credit Rates For Sme Scheme Forrestbrown