modified business tax return instructions

2019 MICHIGAN Business Tax Annual Return. Gross wages payments made and individual employee information.

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Double check all the fillable fields to ensure full accuracy.

. Line Instructions for Forms 1040 and 1040-SR. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - FINANCIAL BUSINESSES ONLY General Businesses need to use the form developed specifically for them TXR-02005 Line 1. Modified Business Tax NRS 463370 Gaming License Fees.

Employer paid health care costs paid this calendar quarter. Modified Business Tax Return-General Businesses 7-1-16 to Current. CARRY FORWARD If Line 5 is less than zero 0 enter amount FEIN of Business Name Above THIS RETURN MUST BE SIGNED FOR DEPARTMENT USE ONLY PERIOD ENDING.

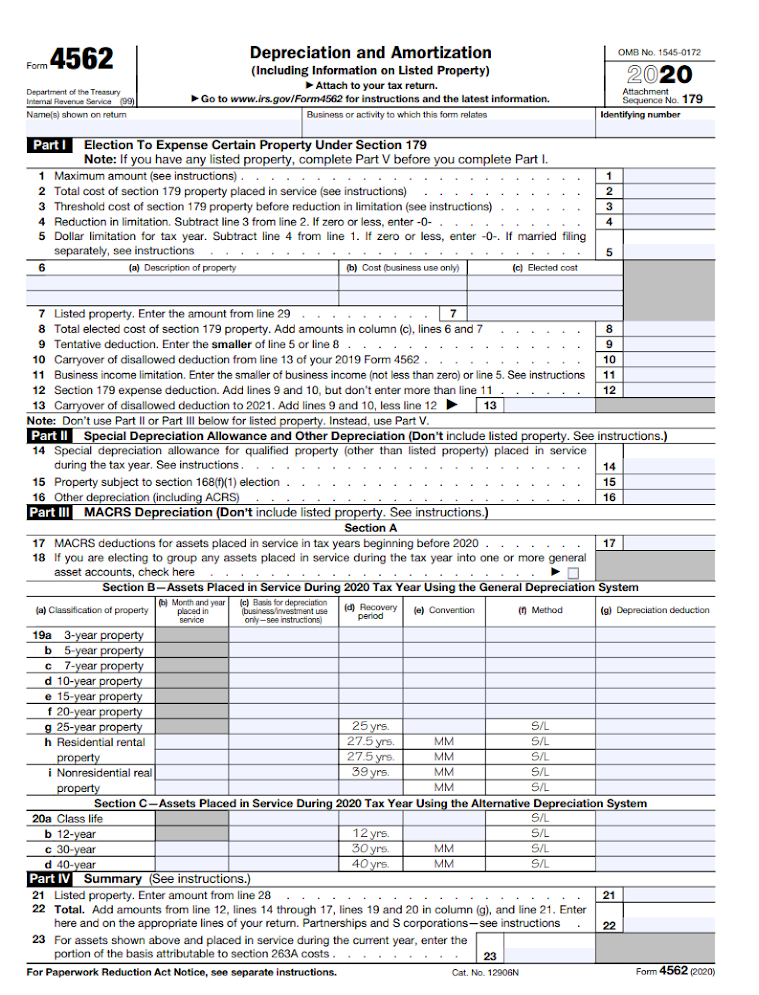

The amended return must include any resulting adjustments to taxable income or to the tax liability for example allowable depreciation in that tax year for the item of section 179 property to which the revocation pertains. Signature Date 1 to 10 11 to 15 16 to 20 21 to 30 31 15. For purposes of the PTC household income is the modified adjusted gross income modified AGI of you and your spouse if filing a joint return see Line 2a later plus the modified AGI of each individual whom you claim as a dependent and who is required to file an income tax return because his or her income meets the income tax return filing threshold see Line 2b later.

Granholm July 12 2007 imposes a 495 business income tax and a modified gross receipts tax at the rate of 08. Abbreviations for names and technical terms each term is spelt out the first time it is used. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter.

Instructions contains information about how to complete each label on the company tax return including company information Items 130 the calculation statement and declaration. Modified Adjusted Gross Income MAGI in the simplest terms is your Adjusted Gross Income AGI plus a few items like exempt or excluded income and certain deductions. Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter.

Social Security Number SSN Dependents Qualifying Child for Child Tax Credit and Credit for Other Dependents. BUSINESS TAX MINING RETURN This form is a universal form that will calculate tax interest and penalty for the appropriate periods if used on-line. Federal Employer Identification Number FEIN or TR Number Doing Business As DBA 8.

If the change in Schedule C changes your business net income profit amount it may change the rest of your tax return including possibly your self-employment tax amount. For more information see the Instructions for Form 944. Use a check mark to point the answer where needed.

PREVIOUS DEBITS Outstanding liabilities AMOUNT PAID 17. Insurance companies and financial institutions pay alternate taxes see below. Malt Beverage and Liquor Tax Forms.

You can find this address on page 3 of the instructions for Form 1120. The Nevada Modified Business Return is an easy form to complete. Learn more Form 4506-T Request for Transcript of Tax Return.

Enter corrected figures in black ink next to. Write the word AMENDED in black ink in the upper right-hand corner of the return. The Office of Tax and Revenue provides the following modified instructions for rental income and expenses reported on the D-30 Unincorporated Franchise Tax Return.

You will need to use Form 1040-X to do this. Form 941 Employers QUARTERLY Federal Tax Return. MAGI can vary depending on the tax benefit.

The MBT replaces the Single Business Tax effective January 1 2008. The amended return must be filed within the time prescribed by law for the applicable tax year. Taxpayer Name print or type 7.

On the S portions Form 8960 worksheet enter the S portions net investment income on line 7 of the trusts Form 8960 and combine line 19a of the Form 8960 worksheet with the non-S portions AGI to arrive at the amount on line 19a. Motor and Alternative Fuel Tax Forms. Total Gross Wages - Enter the total amount of all gross wages and reported tips paid this calendar quarter.

The modified business tax covers total gross wages less employee health care benefits paid by the employer. Employers must file this form quarterly to report income tax withheld on wages and employer and employee social security and Medicare taxes. Include a copy of the original return 2.

Enter your official contact and identification details. Right click on the form icon then select SAVE TARGET ASSAVE LINK AS and save to your computer. Learn more 2017 Instructions for Form 1045 - Internal Revenue.

Re-open the form from your saved location with Adobe Reader or Excel. The IRS uses your MAGI to determine your eligibility for certain deductions credits and retirement plans. Certain small employers must file Form 944 Employers ANNUAL Federal Tax Return instead of Form 941.

File an amended return on Form 1120x by sending the return along with any schedules that changed to the address where you filed your original corporate tax return. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY - Use this form only for the quarterly filing period beginning July 1 2009 Financial Institutions need to use the form developed specifically for them TXR-02101 Line 1. Modified Business Tax.

Line Instructions for Forms 1040 and 1040-SR. Exceptions to this are employers of exempt organizations and employers with household employees only. Medical Marijuana Tax Forms.

The Michigan Business Tax MBT which was signed into law by Governor Jennifer M. See Regulations section 11411-3 c for more details and examples. Return is for calendar year 2019 or for tax year beginning.

It requires data and information you should have on-hand. Modified Business Tax. Other Tobacco Products Tax Forms.

The amended return must be filed within the time prescribed by law for the applicable tax year. If you dont however have this information readily available this simple form can end up taking hours to complete. If you are using Chrome Firefox or Safari do NOT open tax forms directly from your browser.

Total Income and Adjusted Gross Income. MODIFIED BUSINESS TAX RETURN 1. Schedule C is included in your personal tax return Form 1040 or 1040-SR so to amend your business taxes you must amend your entire tax return.

Use the Sign Tool to create and add your electronic signature to signNow the Nevada modified business tax return form. This is the standard. Issued under authority of Public Act 36 of 2007.

When we say you or your business in these instructions we mean either you as a business. Keystone Opportunity Zone KOZ Forms. Most requests will be processed within 10 business days.

Use this as your opportunity to get. Line-through the original figures in black ink leaving original figures legible. BUSINESS TAX GENERAL BUSINESS.

How To Complete Form 1120s Schedule K 1 With Sample

2020 Draft Form 1065 Instruction Indicates Changes In Partners Capital Account Reporting Windes

Form 8995 A Schedule C Loss Netting And Carryforward K1 Schedulec Schedulee Schedulef

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Irs Form 4562 Explained A Step By Step Guide The Blueprint

How To Win The Tax Game And Play Within Its Complex Rules The New York Times

3 12 16 Corporate Income Tax Returns Internal Revenue Service

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More